Did you know TRDATA has a Bond Calculator that lets you view and calculate important bond information? Here are five useful functions to make your trading more efficient.

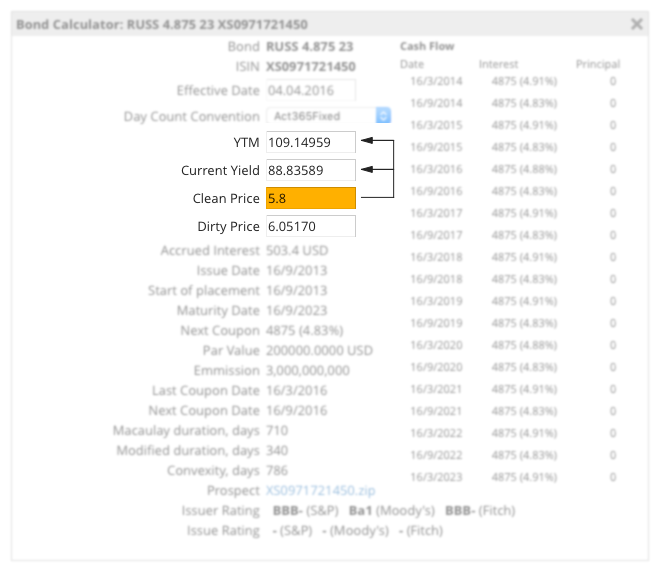

1. Calculate yield

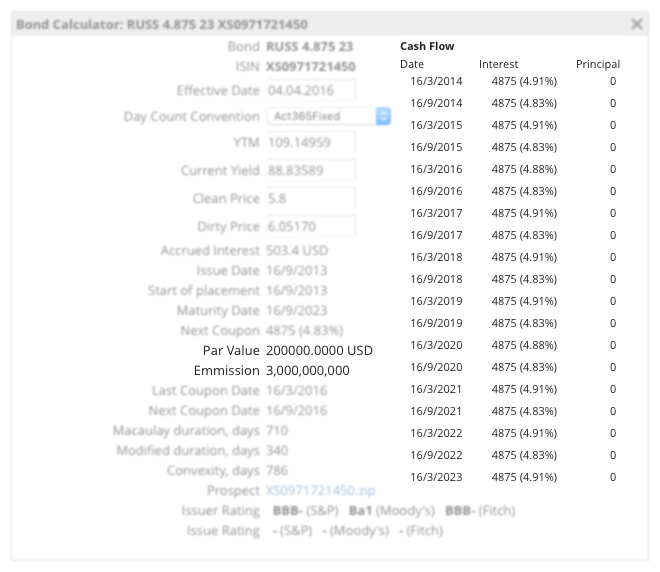

You can calculate the Yield to Maturity, as well as the current yield. Indicate your prospective clean or dirty price, and the calculator will give you the yield (current and YTM) associated with the prices. You can also set your desired day count convention to get more exact results.

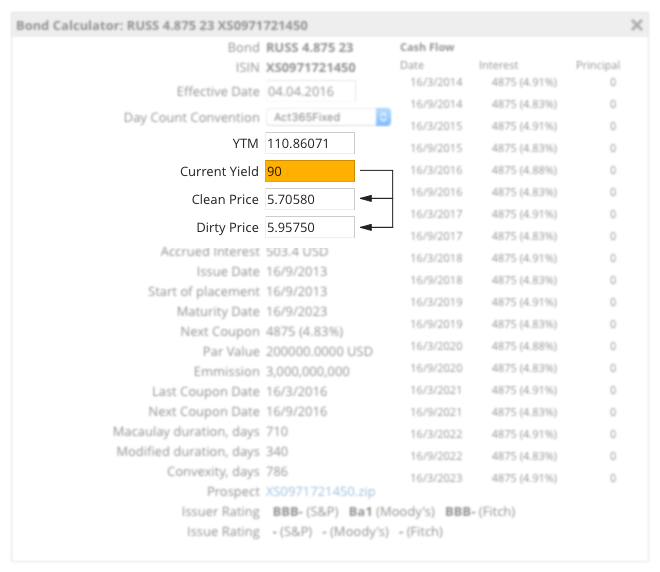

2. Calculate price

You can also calculate clean and dirty price. Set your YTM or current yield amount, and get instant price calculations. In addition, if you type in a specific clean price, the dirty price will be calculated, and vice versa.

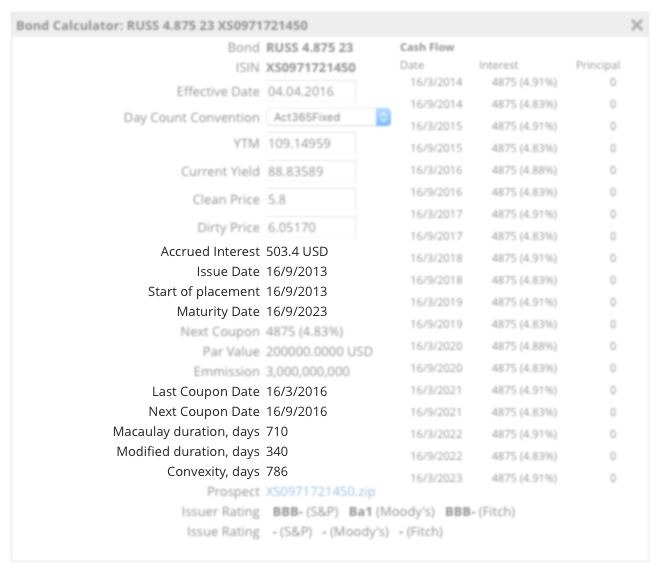

3. View dates at a glance

The calculator provides information on bond issue date, start of placement and maturity date, next and last coupon dates. Macaulay duration and modified duration are shown, too. Duration and convexity in days are adjusted based on the yield and price you input.

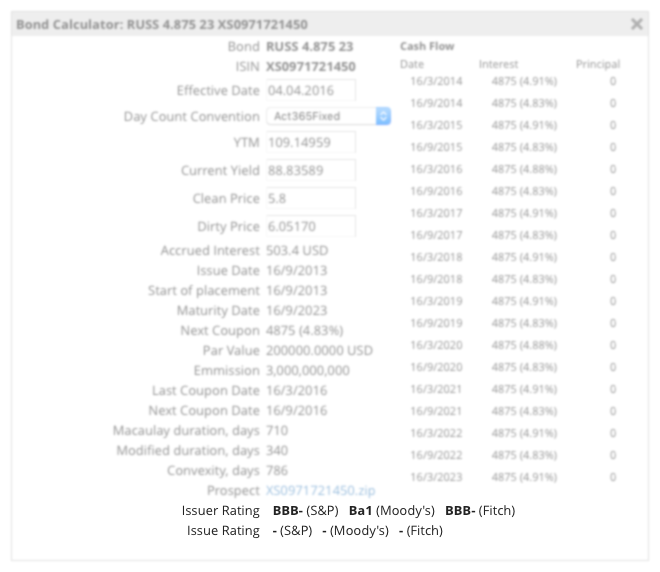

4. View ratings

The bond rating and the issuer rating are listed directly on the widget. Ratings are available from S&P, Moody’s, and Fitch.

5. View other detailed bond information

The par value and emission of the bond are indicated. Also displayed are the next coupon and the coupon rate. You can see cash flow payments and interest listed by date on the right hand side of the calculator.

How do I access the calculator?

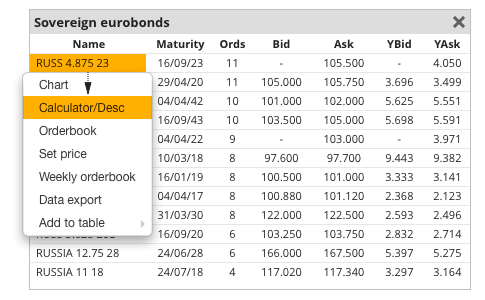

To access the tool, open up any bonds window that interests you– corporate, corporate euro, sovereign, or sovereign euro. Next, click on the name of any one bond to open a popup menu and click on the calculator tab. The bond calculator is now open and will calculate information on that specific bond. If you have any questions about its features, you can always contact us: support@trdata.com

Comments are closed.